The Bourbon Barrel Investment Platform

Gain Access to a Tangible Asset with Steady, Long-Term Growth

— Kentucky Bourbon Barrels.

Check Out This 60-Minutes Video on Bourbon Barrels

Kentucky Bourbon

Our relationships with Kentucky’s top distilleries allow us to broker over

400,000 barrels—offering investors access to high-demand bourbon inventory.

Consumer Demand

Unlike many alternatives, bourbon is backed by real, consumable demand—driven by one of the fastest-growing spirits markets.

Fully Insured

Barrels are secured in bonded facilities with full insurance and built-in exit pathways, ensuring both safety and flexibility.

Build A Brand

These barrels are ready for commercialization by RTD producers, craft brands, and global buyers.

No Correlation

Bourbon barrels offer zero correlation to public markets, making them a strong hedge against traditional equity volatility.

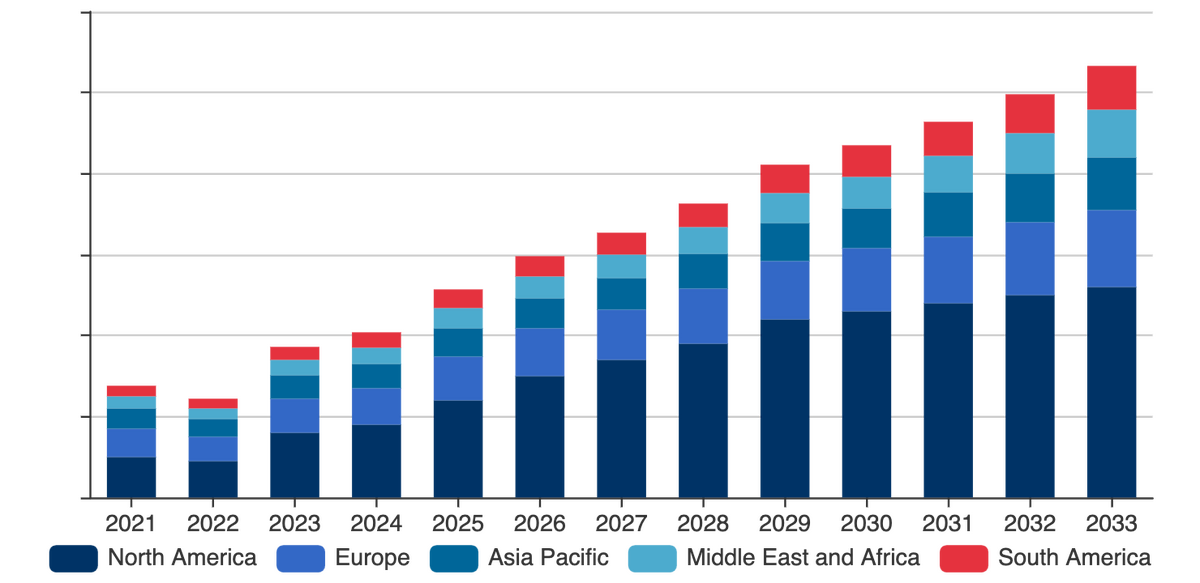

1. Market Share By Region

See how bourbon’s global market share is predicted to expand over the next decade—driven by rising demand across the globe.

2. US Bourbon Growth

The U.S. bourbon industry has been growing rapidly over the past two decades—and show no signs for slowing down.

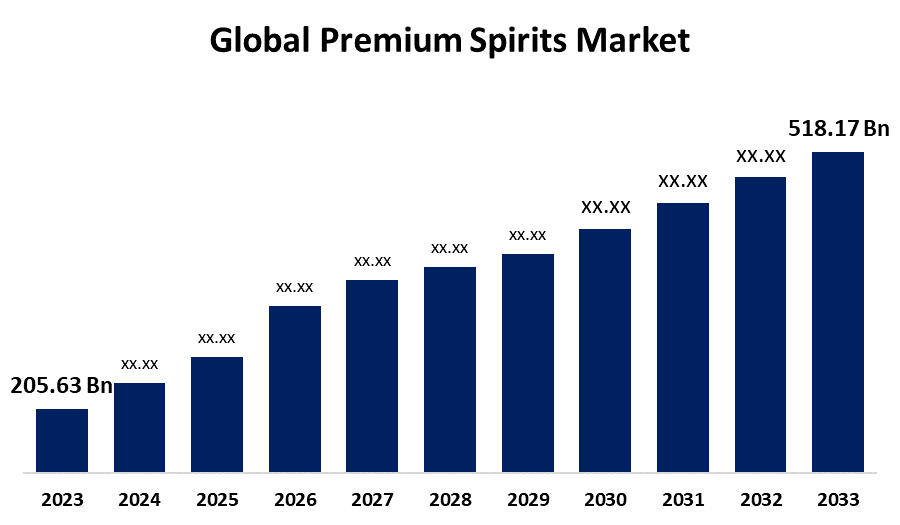

3. Global Spirits Market

As the global premium spirits market expands, bourbon stands out as one of its fastest-growing categories.

Monthly Growth

$25-50

Each bourbon barrel increases in value by $25-50 per month due to the natural aging process.

Past performance is not indicative of future results. Projected growth figures are estimates and not guaranteed.

Average ROI

2-3x

Over the past decade, bourbon barrels have had an average ROI of 2-3x over 24-32 months.

Past performance is not indicative of future results. Projected growth figures are estimates and not guaranteed.

See What Forbes Has To Say About Bourbon

"Every investor’s dream is an asset that requires very little work, maintenance, goes up consistently over time and pays royally. From what I’ve seen, bourbon barrels fit that description.” - Forbes

See What LA Weekly Has To Say About Bourbon

"Investing in whiskey barrels offers a unique opportunity to diversify one’s portfolio, enjoy potential appreciation, and protect assets during turbulent economic times." - LA Weekly

Book A Call Here To Learn More

Have questions? We’re happy to talk—call us anytime at 312-543-2228.

© The Bourbon Partners. All rights reserved.

SAFE HARBOR STATEMENT - Certain statements herein represent forward looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause the financial results a Buyer may receive from any investment in a bourbon barrel to be materially different from the future profits or financial results as expressed or implied by such forward-looking statements. LexCap, and its affiliates, has attempted to identify these forward looking statements with the words "believe," "estimate," "continue," "seek," "plan," "expect," "intend," "anticipate," "may," "will," "could" and other similar expressions. Although these forward-looking statements reflect our expectations related to ones potential profits and financial results in connection with the investment in a bourbon barrel, such forward looking statements are based on information available to us now, which is subject to change, and they are inherently subject to certain risks and uncertainties or unknown events. These risks, uncertainties and unknown events, include, but are not limited to, the following: the highly regulated nature of the spirits industry and the requirements that may be imposed on a buyer due to changes in the law after a buyer acquires a bourbon barrel; changes in consumer and commercial demand for whiskey or bourbon; loss of bourbon due to evaporation or leakage; market competition for the sale of bourbon barrels; negative perception for the distillery who manufactured the bourbon in your barrels; and/or lack of a public market for bourbon barrels which may result in the need to hold your investment for an extended period of time due to the lengthy maturation process related to bourbon. LexCap, and its affiliates, are under no obligation to update any forward-looking statements after the date of this publication.